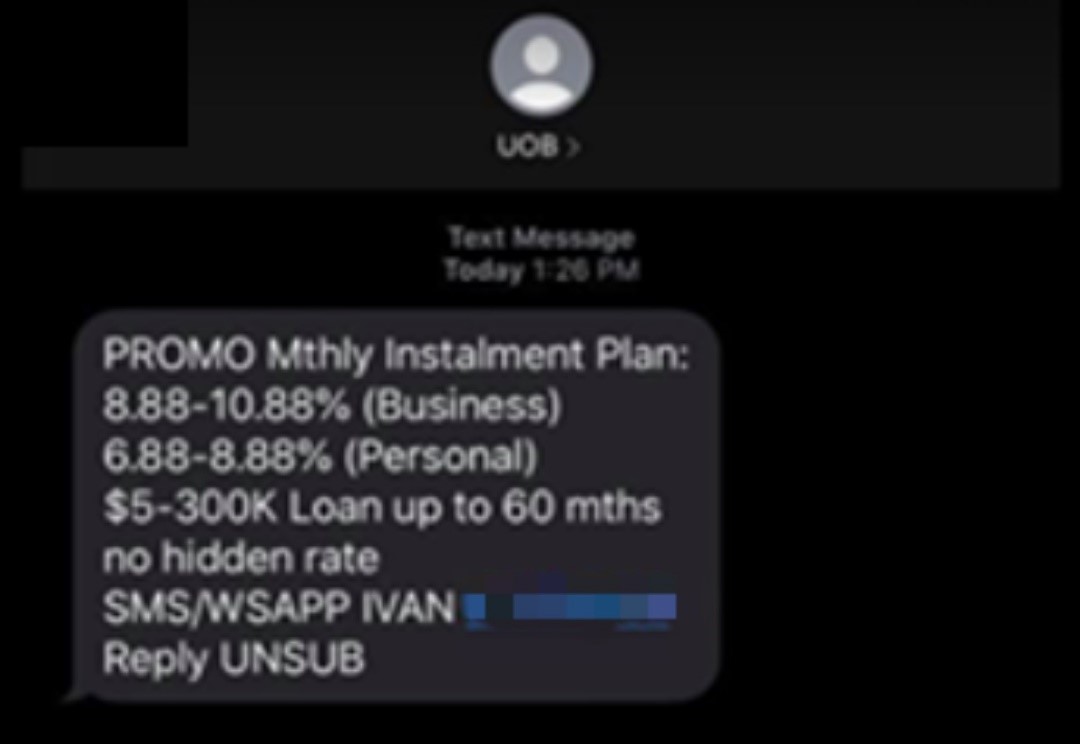

The Police have observed the emergence of a new variant of scam targeting bank customers where members of the public would receive loan advertisement messages purportedly sent by banks such as UOB.

UOB has confirmed that they do not send out such loan advertisements.

Members of the public are advised to adopt the following crime prevention measures:

a. Beware of unsolicited messages or calls from persons impersonating as staff from banks. Scammers may use Caller ID spoofing technology to mask their actual phone number to display the bank’s number and logo as the profile picture on mobile applications such as ‘Viber’ and ‘WhatsApp’. Ignore such messages and do not reply to them. Instead, block or report the number as spam on WhatsApp or through third party applications.

b. If you receive a suspicious call or message purportedly from your bank, hang up the call and do not reply to the message. Call the bank’s hotline published on its website to verify the authenticity of the request. Do not call the number provided by the caller, or shown in the message.

If you wish to provide any information related to such scams, please call the Police hotline at 1800-255-0000, or submit it online at www.police.gov.sg/iwitness. If you require urgent Police assistance, please dial ‘999’.

You can also call the National Crime Prevention Council’s X Ah Long Hotline at 1800–924 –5664 if you have any information pertaining to unlicensed moneylenders. To seek scam-related advice, you can call the National Crime Prevention Council’s anti-scam helpline at 1800-722-6688 or visit www.scamalert.sg.

SINGAPORE POLICE FORCE

09 March 2020 @ 3:00 PM