The Police are investigating seven persons for their suspected involvement in a case of loan scam after their bank accounts were found to have been used to receive money from a scam victim. Preliminary investigations revealed that that the victim had fallen prey to a loan scam after he visited a bogus moneylender’s website. The victim was scammed into making numerous payments in order for his loan application to be approved by the bogus moneylender.

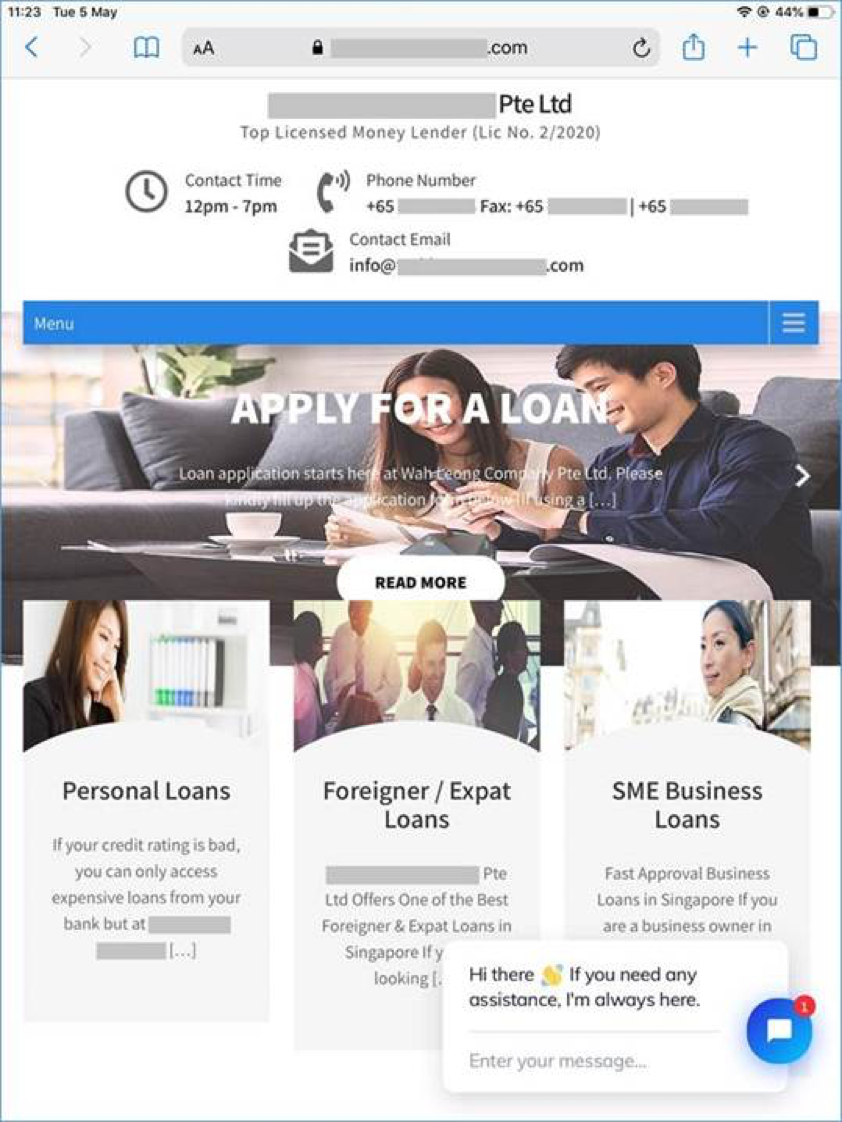

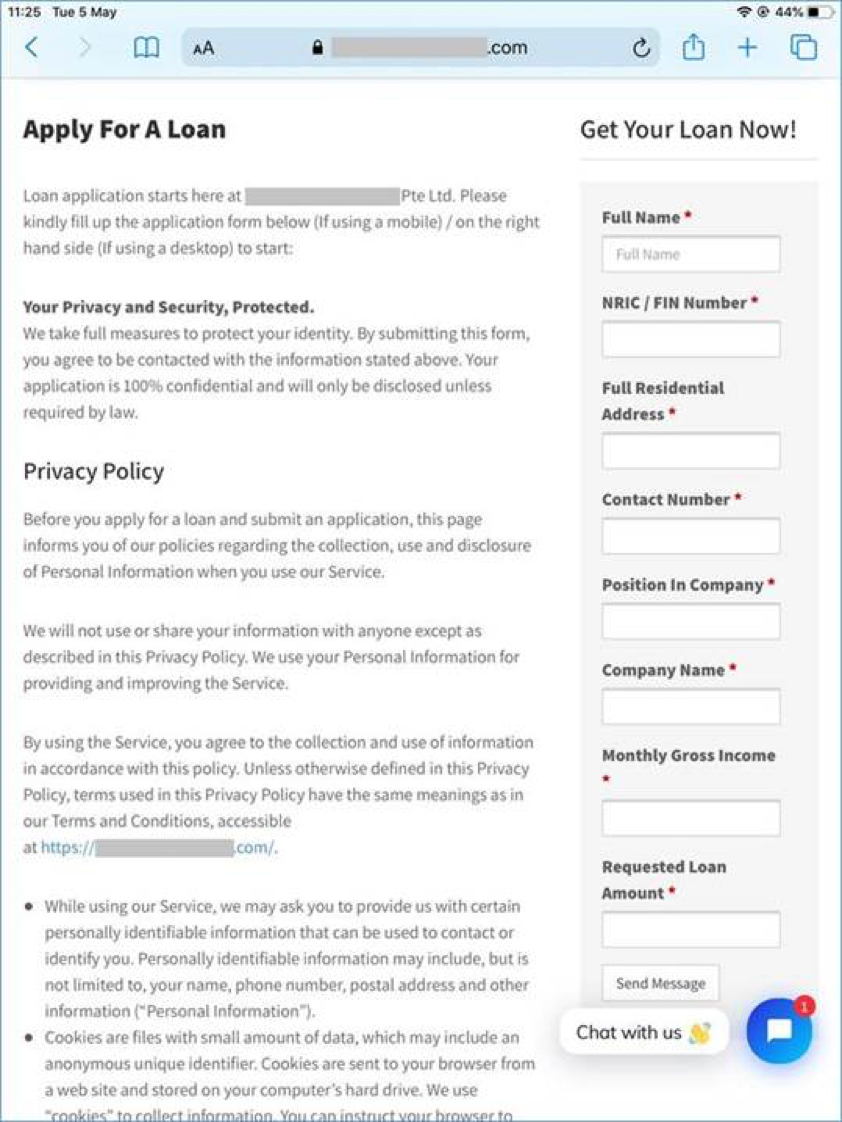

The Police would like to alert the public that loansharks and scammers have turned to impersonating licensed moneylenders to deceive victims. In some instances, they create bogus websites portraying themselves as licensed moneylenders in Singapore. Such websites solicit victims’ personal information such as their NRIC number, address and contact number, which can then be used by loansharks and scammers to harass or further scam their victims.

Members of the public are advised to be wary when they come across websites advertising loans. The Police would like to advise members of public on the following:

(a) A licensed moneylender is not allowed to make any cold calls or send any unsolicited text messages to members of the public. Do not respond to these calls or messages.

(b) Visit the MinLaw Registry of Moneylenders’ website for the list of licensed moneylenders (https://rom.mlaw.gov.sg/information-for-borrowers/list-of-licensed-moneylenders-in-singapore/), instead of relying on online searches which might surface fraudulent websites masquerading as licensed moneylenders.

(c) Do not provide your personal information such as NRIC, SingPass or bank account details to anyone you do not know, or to unverified sources.

(d) A licensed moneylender must first meet you in person physically at the approved place of business before granting you a loan. The approved place(s) of business is published in the same list of licensed moneylenders (https://rom.mlaw.gov.sg/information-for-borrowers/list-of-licensed-moneylenders-in-singapore/).

(e) A licensed moneylender will not ask a loan applicant to make any payment before the disbursement of the loan. This includes GST, “admin fee”, “processing fee”, or any other fees. An administrative fee may be charged by the licensed moneylender after the loan has been granted, but this will usually be deducted from the loan principal that is disbursed to the borrower.

If you wish to provide any information related to such scams, please call the Police hotline at 1800-255-0000, or submit it online at www.police.gov.sg/iwitness. If you require urgent Police assistance, please dial ‘999’. Members of the public can call the X-Ah Long hotline at 1800-924-5664 if they suspect or know of anyone who could be involved in illegal loansharking activities. To seek scam-related advice, you may call the anti-scam helpline at 1800-722-6688 or go to www.scamalert.sg.

SINGAPORE POLICE FORCE

15 May 2020 @ 12:40 PM