Scams continue to be a concern but we can better protect ourselves by being vigilant!

By: Ng Yun Shiean and Mike Tan

Scams and cybercrime remained a pressing concern in 2024. Last year, the number of scam and cybercrime cases increased by 10.8% to 55,810 cases, compared to 50,376 cases in 2023. Here are five things you should know about scams last year.

1. The total amount lost to scams in 2024 was at least $1.1 billion, with more than $182 million successfully recovered

In 2024, the total number of scam cases increased by 10.6% to 51,501 cases, from 46,563 cases in 2023. The total amount lost also increased by 70.6% to at least $1.1 billion in 2024, from at least $651.8 million in 2023. The increase in total amount lost was driven by a small number of cases with very high losses (for example, four cases accounted for $237.9 million in losses).

In 2024, the Anti-Scam Command (ASCom) successfully recovered more than $182 million of scam losses, and the net scam losses was about $930 million. Through proactive interventions with victims at various stages of being scammed, the ASCom and its partners averted at least another $483 million in potential losses.

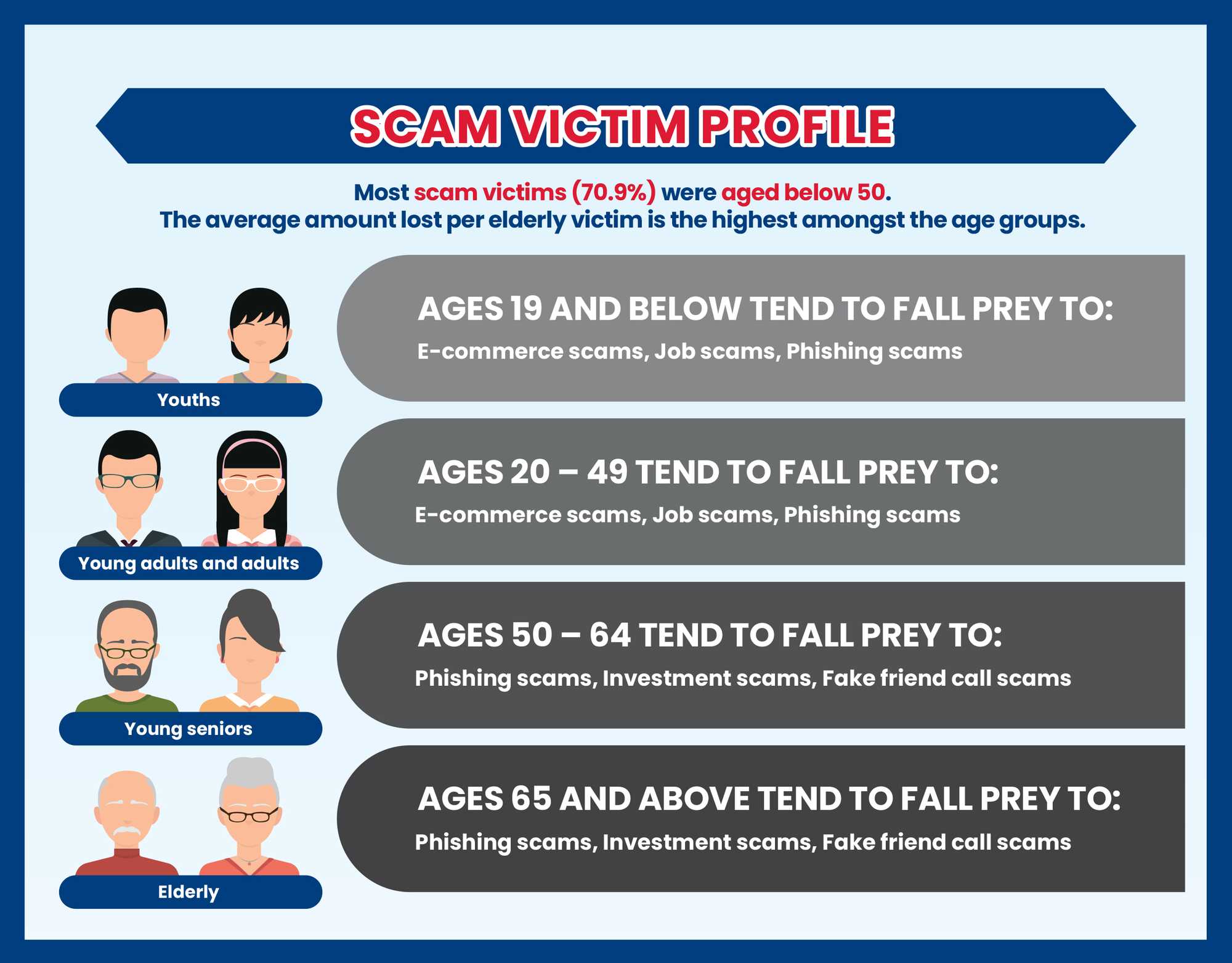

2. Those aged below 50 made up the majority of scam victims

In 2024, 70.9% of scam victims were youths, young adults and adults aged below 50. As for the elderly, while they made up only a small proportion of the scam victims, the average amount they lost per victim is the highest among the various age groups.

3. Fake friend call scams, malware-enabled scams and social media impersonation scams declined in 2024

There were significant decreases in both the number of cases reported and total amount lost for fake friend call scams, as well as notable decreases in the number of malware-enabled scams and social media impersonation scams. This was largely due to several measures implemented by the Government and stakeholders like the banks and telcos.

On the other hand, there were increases in the number of e-commerce scams, phishing scams, investment scams and government official impersonation scams.

4. Self-effected scams remain a concern

In 2024, self-effected transfers accounted for 82.4% of total reported scam cases. In most of these cases, the scammers did not gain direct control of the victims’ accounts, but manipulated victims into performing the monetary transactions, by means of deception and social engineering.

5. The Police will continue to fight scams through a range of measures, such as including tapping on legislative levers and conducting enforcement operations

Such measures include tapping on legislative levers such as the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act (CDSA) and the Computer Misuse Act (CMA).

In one concluded case, the offender received RM1,000 (approximately S$300) for sharing access of his internet banking account with another person, without taking reasonable steps to ascertain the purpose of this arrangement. The bank account was then used to launder more than $160,000 of criminal proceeds. The offender was convicted and sentenced to six months’ imprisonment and was required to disgorge the unlawful gain made from the arrangement.

Amendments to the Miscellaneous Offences Act that came into effect on 1 January 2025 will also target the misuse of local SIM cards to perpetrate scams (for example, receiving scam monies and setting up messaging accounts).

On the enforcement front, in 2024, the ASCom, together with the Scam Strike Teams in the seven Police Land Divisions, conducted 25 island-wide anti-scam enforcement operations, leading to the investigation of more than 8,000 money mules and scammers. Police have also charged more than 660 scammers and money mules in Court, including more than 110 of them under the new laws of the CDSA and CMA.

Annual Scams and Cybercrime Brief 2024

To learn more about the Annual Scams and Cybercrime 2024, download the Brief and its related infographic.